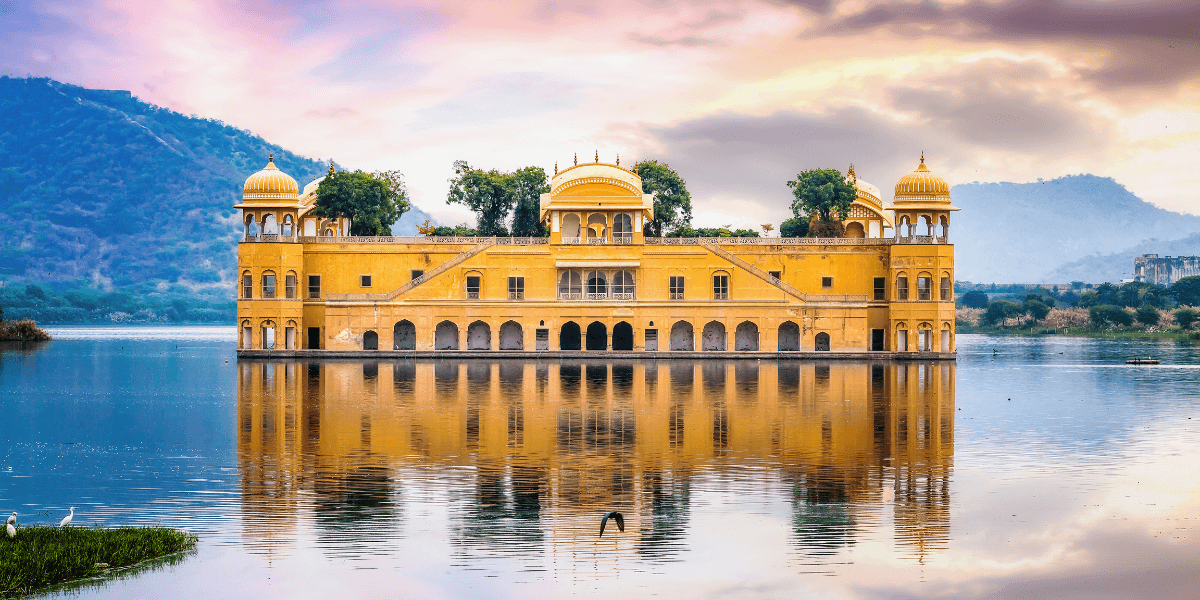

Unlocking Financial Flexibility: In-Depth Guide To Get A Personal Loan in Jaipur

The Pink City of Rajasthan is not only one of India's largest tourist attractions but also a hub for many multinational companies and BPOs. With this extensive economic exposure, Jaipur's cost of living is gradually increasing. There may be instances where one needs more funds because the usual monthly income and savings are insufficient. In such instances, a personal loan in Jaipur is one of the most common credit options and may be used to quickly and easily get the money needed to address any emergency or financial crisis.

It is important to do a little research and understand the different options available to make an informed decision.

Understanding Personal Loans:

Personal loans are an unsecured type of credit that is offered by almost all major financial institutions based on the borrower's creditworthiness and repayment ability without having to pledge any collateral. Personal loans are a popular way for individuals in Jaipur to access funding for various reasons, including paying high-interest debts, financing a marriage, home improvements, or unexpected medical expenses.

Factors to be considered when looking for a Personal loan

Here are some important factors that should be considered before applying for a personal loan in Jaipur:

Sufficient loan amount: Before applying, the borrower should thoroughly scan through their requirements and apply for a sufficient loan amount so that it covers the need without becoming a liability.

Interest rate: Interest rates may vary between lenders and can have a significant impact on the total repayment amount. The applicant should compare interest rates from multiple lenders to find the best deal.

Processing fees and other charges: Personal loans often come with additional fees and charges, such as processing fees, late payment fees, and prepayment charges. The borrower must be aware of all the fees that are associated with the loan and factor them into their calculation.

Repayment tenure: The length of time that the loan must be repaid is known as the repayment term and is decided upon at the time of application by both the lender and the borrower. A longer repayment tenure means a lower EMI but a higher interest amount.

The reputation of the lender: It is important to choose a reputable lender with a good track record of customer service.

Where and How to Get a Personal loan quickly?

With major financial institutions providing a personal loan in Jaipur, the traditional process of applying separately with all those financial institutions and waiting for approval may be cumbersome. In the digital era, this lengthy process can be avoided by applying online with one of the fastest-growing financial consultants – Nowofloan.

Nowofloan works with various NBFCs and provides a simplified and user-friendly platform to apply for a personal loan online. We provide a premium service to our clients and help them get a personal loan from one of our partnered NBFCs.

Who are Eligible to Apply for a Personal Loan through Nowofloan?

- The applicant should be an Indian.

- The minimum age of the applicant should be 21.

- The monthly income should be at least Rs.15,000 which must reflect in the bank account statement.

- The credit score of the applicant should be 750 or more.

What documents are required to Apply for a personal loan?

Following are the documents required to apply for a personal loan in Jaipur:

- Aadhar Card

- PAN card

- Utility bill or a rent agreement

- Photographs

- Salary slips or bank statements

To summarize, personal loans can be a valuable financial tool for an individual who needs access to funds quickly without providing any collateral to pledge. By carefully analyzing the financial requirements and carefully choosing a suitable lender, one can easily manage to get a personal loan in Jaipur to achieve financial goals and improve overall financial well-being.

Ease Your Monetary Stress Quickly – Apply for Instant Personal Loan Now!