A Fantastic Range of Personal Loans!

Whatever your personal loan requirement is, we've always got the best option for you. From varied options of loan tenure, you can opt for the most convenient one and materialize your dreams to garnish your life.

- Salary : ₹ 15,000 / Month

- Loan Amount : ₹ 1,00,000/-

- Interest Rate : 12.5%

- EMI : ₹ 8,908 / Month

- Salary : ₹ 25,000 / Month

- Loan Amount : ₹ 3,00,000/-

- Interest Rate : 12.5%

- EMI : ₹ 10,036 / Month

- Salary : ₹ 50,000 / Month

- Loan Amount : ₹ 7,00,000/-

- Interest Rate : 12.5%

- EMI : ₹ 15,749 / Month

- Salary : ₹ 80,000 / Month

- Loan Amount : ₹ 10,00,000/-

- Interest Rate : 12.5%

- EMI : ₹ 19,811 / Month

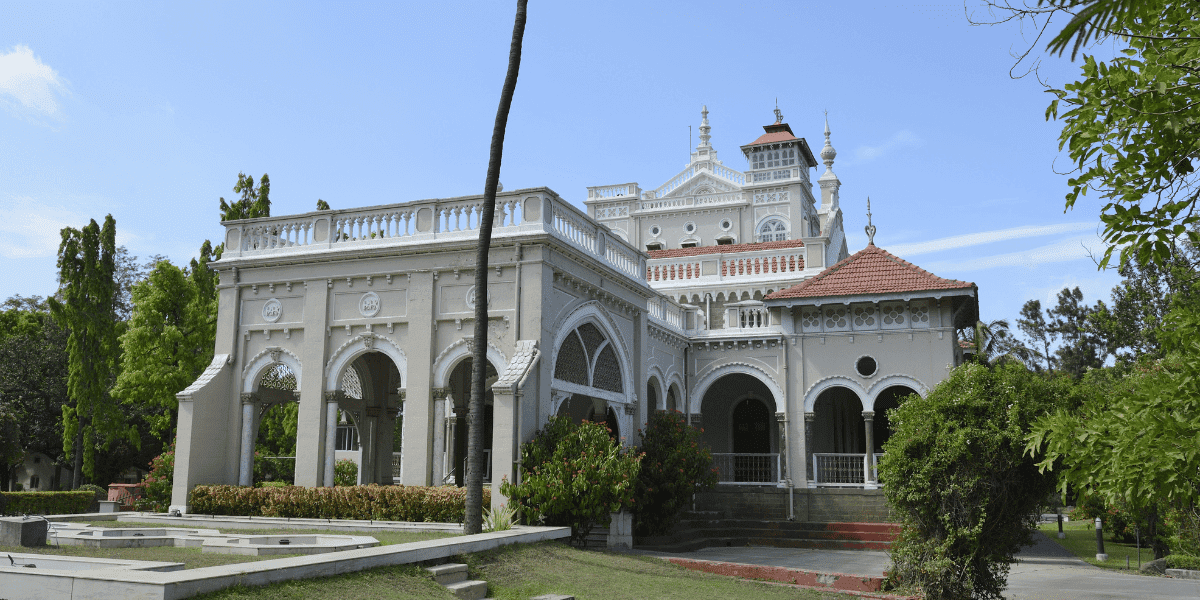

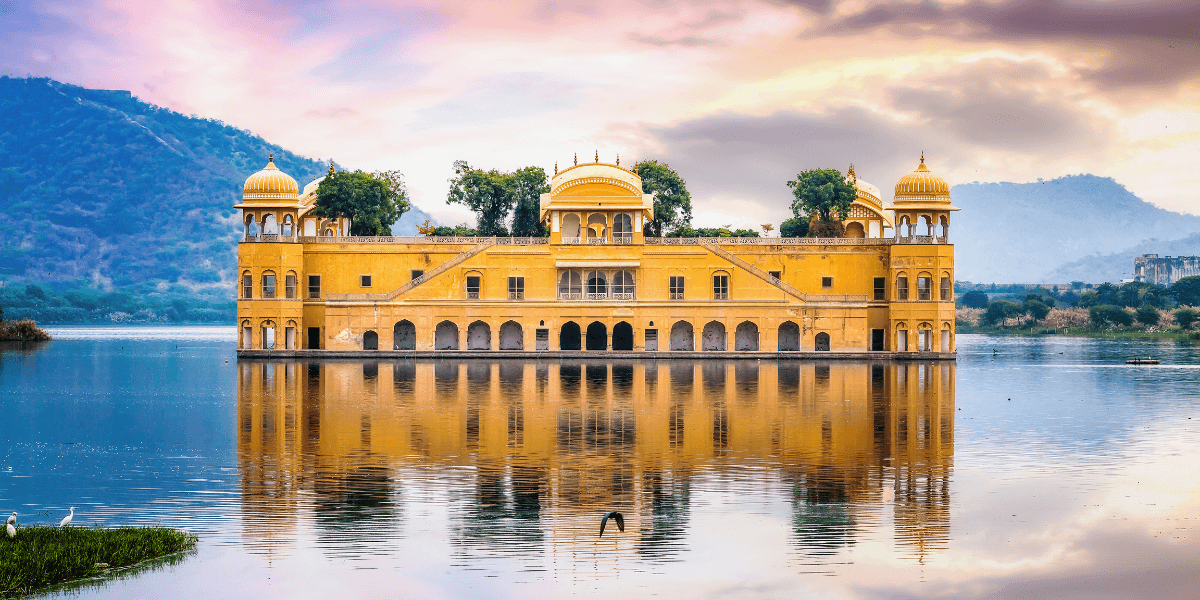

A Quick Personal Loan for All Purposes!

You may need some urgent money to hit the path of your dream vacation, or re-colour your faded house walls, or even pay some emergency medical bills. Whatever the reason for the need for urgent money is, you're just some minutes away from availing your Instant Personal Loan through Nowofloan.

A Personal Loan can be used to meet financial requirements for:

Premium Membership Card for Unlimited Benefits

Once you get Nowofloan's Premium Membership Card, there's no looking back! You can get personal loan offers from multiple banks - all at the comfort of your home. Just make some clicks and get instant loan offers depending upon your eligibility. It should be noted that the Premium Membership Card is not any sort of credit or debit card and the customer should not be of the impression that buying this card means getting money in the bank. Membership Card is limited to our company only, providing certain benefits. Buying a Premium Membership Card has a wide range of benefits that can help the loan seeker in easing the entire process of applying for a personal loan. Let's look at the specific perks of the membership card. You can avail of your pre-approval loan offer from multiple banks through just a single platform - Nowofloan. The company provides its customers with a decade-long free consultancy - assisting at every stage of the loan process. With the membership card, you can even earn a payout of up to 60% through referrals.

Get Pre-Approved Loan Offer

You can get loan offers from multiple banks and NBFCs - allowing you to choose the best loan offer as per your requirement and convenience.

6 Months Free Consultancy

This is a very helpful feature of the Premium Membership Card that assists you in getting your personal loan offer for a span of 31 year.

Refer & Earn up to 60%

You can even make good money through referrals. This means that in addition to getting loan offers from multiple banks, you can earn some extra money!

Avail Quick & Instant Personal Loan from Nowofloan

Nowofloan is completely dedicated to providing all its customers with wholehearted assistance and helping them with their personal loan requirements. For the same purpose, we have a streamlined and transparent process of giving you personal loan offers from multiple banks and NBFCs. This facility provided by Nowofloan will let you get a personal loan depending upon your eligibility.

Just after a very quick registration and once you get the Premium Membership Card, the Nowofloan team will submit your loan file to multiple banks and the loan offers will be sent to you from the banks under which your eligibility matches.

Check Eligibility for Personal LoanHow to apply for a Personal Loan at Nowofloan?

1

Quick Registration

The first and foremost step remains the filling of a very simple form to be filled by the loan seeker. The process of filling the registration form can hardly take 5 minutes.

2

Check Eligibility

You will be able to check for your eligibility for the loan – just after the quick registration process.

3

Buy Membership

This is the best feature of Nowofloan through which you can get your Membership and receive pre-approved loan offers from multiple banks.

4

Submit Documents

The next step would be the submission of your documents, via Whatsapp or on the customer portal, which would be used for further loan processing.

5

Bank Verification

In this, the bank will evaluate your documents and profile as per their rules and regulations.

6

Bank Sanction

This directly depends on the customer's profile and bank criteria & rules. The final loan approval & disbursement depends on the banks as per their rules.

Why Nowofloan.com?

Being India's #1 Digital Loan Provider, Nowofloan is partnered with multiple banks and NBFCs to provide you with the best personal loan that suits you and fulfils your financial goals or immediate monetary needs. With some amazing features and provisions, Nowofloan is a one-stop digital solution for catering to your personal loan needs.

100% Online Loan Process

We offer a completely digital loan process, making the process faster and more effective for our customers.

Minimum Documents Required

Depending upon the customer profile, the concerned documents can be easily submitted.

Tie-up with Multiple Banks & NBFCs

A personal loan offer of up to INR 15,00,000 (depending upon customer profile) can be offered from multiple banks.

Good Range of Annual Percentage Rate

The range of annual percentage rates, starting from 12.5% to 24%, enables the customer to opt for the most convenient loan offer.

Flexible Repayment Terms

Depending upon the loan offer, the customer is facilitated with flexible repayment terms with loan tenures ranging from 1 Year to 6 Years.

Provision of Premium Membership Card

The customer can avail of loan offers from multiple banks through a 100% online loan process. Also, 6 Months of free consultancy is a great plus.

What is a Personal Loan?

A personal loan is an official lent money to an individual by banks or NBFCs (private financial firms) after the person's loan file is approved by the concerned firm. A personal loan falls under the category of unsecured credit - meaning that the loan is provided against no collaterals. As personal loans need no security, the rate of interest is comparatively higher than the loans that include collateral.

An individual can opt for a personal loan in case of any financial urgency like - a medical emergency, unplanned vacation trips, urgent rental deposits, domestic needs, buying a vehicle, or any other. A personal loan can easily be taken by salaried people by submitting their income proof and documents of professional stability.

Advantages of a Personal Loan

Urgent money can be needed at any stage of life, at any given instance of life. And everyone cannot be financially sound to fulfil that urgent need of money. Here, the best option is to get a personal loan because it can be accessed in less time - only after the loan file is approved by the bank or financial company. Once the loan is taken by the person, he/she can repay the loan through monthly EMIs (Equated Monthly installments). The EMI is dependent upon the loan amount and the decided tenure.

Also, taking a personal loan is very advantageous when it comes to meeting urgent financial challenges. Whenever a person is short of money and has some financial commitments, he/she can easily avail of a personal loan (if the loan application is approved) and fulfil the monetary requirements.

Personal loan eligibility criteria for Salaried Persons

If you are a salaried person and if you seek a personal loan, there are some standard eligibility criteria that are to be met:

- Minimum Age - 21 Years

- Minimum Salary - Rs. 15,000 / month

- 1 Year Job Stability

Personal loan eligibility criteria for Self-Employed Persons

There are some specified criteria for the loan seekers who are self-employed. Let's have a look at them:

- Minimum Age - 21 Years

- Income Tax Return of Minimum 1 Year

- 1 Year Business Stability

Convenient Loan Tenure

Nowofloan understands that a personal loan is a thing that can't embrace a stringent one-fits-all approach. And for the same reason, a loan seeker can find an excellent range of loan tenure options to choose from. Depending upon your convenience, you can opt for a loan tenure of 1 year, 2 years, 3 years, 4 years, 5 years, and 6 years. It must be noted that for opting for a particular loan, the loan seeker's loan file shall meet all the requirements and criteria of the concerned bank or NBFC. Some of the factors that decide your loan approval are income proof, professional stability, loan amount, CIBIL score, etc.

No Requirement of Collateral

As a personal loan is categorized as unsecured credit, no bank would ask for any collateral security against the personal loan. This is a great feature for the personal loan seekers as they have to give no guarantee; having said that, the documents presented during the loan process are considered as the guarantee for loan repayment.